UniDex represents a paradigm shift in decentralized trading infrastructure. Unlike traditional DEXs limited to basic swap functions, UniDex delivers sophisticated trading tools previously exclusive to centralized exchanges. The UniDex platform aggregates liquidity across multiple blockchains, enabling seamless trading experiences regardless of asset location. This groundbreaking approach positions UniDex as the most versatile trading terminal in Web3.

Decentralized finance suffers from fragmented liquidity and primitive execution options. Most platforms lack essential features like stop-loss orders or limit entries, forcing traders into risky manual interventions. Slippage and failed transactions plague users during volatility. UniDex directly addresses these pain points by introducing institutional-grade functionality to the decentralized landscape.

Across Ethereum, Arbitrum, Polygon, and other chains, assets remain siloed. UniDex solves this through its revolutionary cross-chain aggregation engine. When executing trades via UniDex, the protocol scans all integrated networks for optimal pricing, ensuring users always get superior execution.

UniDex introduces game-changing features that redefine DeFi possibilities:

UniDex supports stop-loss, take-profit, trailing stops, and limit orders with custom expiration timelines. These tools empower UniDex traders to implement complex strategies without constant monitoring. The UniDex order book processes instructions on-chain with unmatched reliability.

UniDex technology enables true cross-chain trading without bridging assets. Users can trigger Ethereum-based trades from Polygon or execute Arbitrum positions via BNB Chain. This interoperability makes UniDex the most flexible trading hub in existence.

UniDex offers up to 30x leverage across major crypto pairs through decentralized perpetual contracts. The UniDex leverage engine features real-time funding rate calculations and impermanent loss protection mechanisms unseen in competing platforms.

The $UNIDX token fuels ecosystem operations with multifaceted utility:

Token holders govern UniDex protocol upgrades through decentralized voting. Fee structures dynamically adjust based on UniDex token staking tiers. Premium features unlock for long-term UniDex supporters. Deflationary mechanisms include aggressive buyback programs funded by platform revenue.

Staking UniDex tokens generates yield from trading fees while boosting user privileges. Higher staking tiers reduce UniDex transaction costs and provide early access to new features. The UniDex staking dashboard offers customizable lockup periods for optimized rewards.

UniDex employs battle-tested smart contracts audited by top blockchain security firms. The non-custodial design ensures users maintain asset control. UniDex implements multi-signature treasury management and real-time threat monitoring. Insurance fund mechanisms protect against extreme volatility events.

Unlike hybrid platforms, UniDex never holds user assets. Trades execute directly from personal wallets via UniDex's secure transaction relayers. This eliminates counterparty risk while preserving DeFi's permissionless ethos.

UniDex features an intuitive interface with professional charting tools and real-time analytics. Customizable dashboards allow personalized workspace configurations. The UniDex mobile app delivers full functionality on iOS and Android with push notifications for order executions.

UniDex Academy offers free trading courses and strategy workshops. New users access UniDex tutorial vaults explaining advanced features. The platform's simulated trading environment lets beginners practice risk-free before deploying capital.

UniDex scans hundreds of DEXs and liquidity pools across integrated chains. The algorithm calculates optimal routing paths while factoring in gas costs and slippage. UniDex consistently delivers better pricing than individual exchanges through this sophisticated aggregation.

Large orders automatically split across multiple venues to minimize market impact. UniDex dynamically adjusts routing based on real-time liquidity conditions. This technology makes UniDex particularly advantageous for institutional-scale transactions.

UniDex provides comprehensive APIs for third-party integration. Developers build custom interfaces atop UniDex infrastructure while accessing shared liquidity. The UniDex grant program funds promising ecosystem projects expanding platform capabilities.

Traders install specialized tools from UniDex's developer community. Plugins range from technical indicators to automated strategy bots. Each undergoes rigorous UniDex security review before marketplace listing.

UniDex continuously integrates new blockchain networks based on community governance. Recent additions include Optimism and Avalanche support. The UniDex roadmap prioritizes zkSync Era and StarkNet deployments next quarter. This multi-chain approach future-proofs UniDex against ecosystem evolution.

UniDex aggressively optimizes for Layer-2 scaling solutions. Transactions on Arbitrum and Polygon cost fractions of mainnet fees while maintaining security. UniDex pioneered gasless transaction models through meta-transaction implementations.

While basic DEXs focus on token swaps, UniDex delivers comprehensive trading suites. No competitor matches UniDex's combination of cross-chain access, advanced orders, and leverage trading. The platform's unique value proposition explains UniDex's accelerating adoption metrics.

Hedge funds and trading firms increasingly utilize UniDex for decentralized operations. The platform's OTC desk facilitates large block trades with customized settlement terms. UniDex corporate accounts feature dedicated relationship managers and SLA guarantees.

UniDex's 2024 roadmap includes options trading, portfolio margining, and social copy-trading features. The team plans decentralized identity integration for compliant institutional access. UniDex will launch its own Layer-3 solution for sub-second trade execution.

Machine learning algorithms will power UniDex's next-generation trading assistants. Predictive analytics provide market insights while automated risk management tools protect positions. These innovations reinforce UniDex's technological leadership.

UniDex transitioned to full DAO governance last quarter. UNIDX token holders now vote on treasury allocations and protocol upgrades. Recent successful proposals include UniDex's referral program redesign and Polygon zkEVM integration. This democratic approach ensures UniDex evolves according to user needs.

Staked UniDex tokens generate voting power proportional to commitment duration. The governance interface features discussion forums and proposal simulations. Active participants earn UniDex reputation badges granting elevated influence.

UniDex eliminates compromises between security and functionality. The platform combines CEX-like tools with true decentralization. For leveraged positions, spot trading, or cross-chain operations, UniDex delivers unparalleled performance. Over 150,000 active traders now rely on UniDex monthly.

"UniDex saved my portfolio with automated stop-loss during the LUNA crash," reports a DeFi veteran. An algorithmic trader notes: "UniDex's API allows complex strategy implementation impossible elsewhere." Such endorsements validate UniDex's value proposition.

New users connect wallets via UniDex's intuitive onboarding flow. The platform suggests optimal networks based on asset holdings. Demo mode allows feature exploration with test funds. UniDex's gas estimator helps budget transaction costs before execution.

Power users customize UniDex workspace layouts and hotkeys. Notification thresholds alert for price movements or order fills. API keys enable automated trading system integrations. UniDex preserves settings across devices via encrypted cloud sync.

UniDex fundamentally transforms decentralized trading through relentless innovation. By solving liquidity fragmentation and introducing sophisticated tools, UniDex empowers traders of all levels. The platform's cross-chain architecture and community governance ensure long-term relevance. As DeFi matures, UniDex remains at the forefront, consistently delivering groundbreaking solutions that push blockchain trading forward.

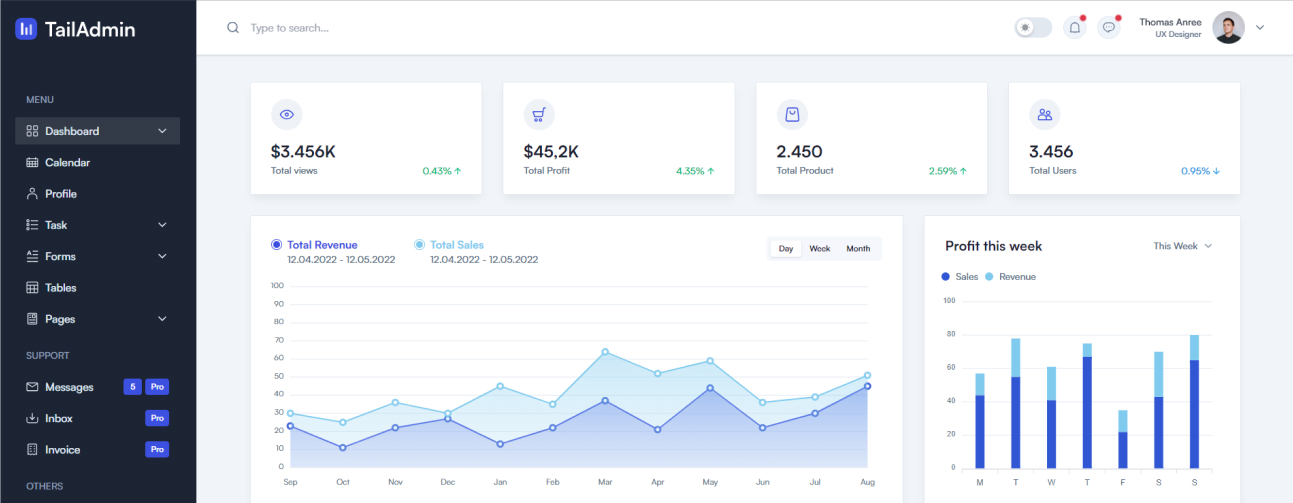

Search on Youtube!Multidisciplinary Web Template Built with Your Favourite Technology - HTML Bootstrap, Tailwind and React NextJS.

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

The main 'thrust' is to focus on educating attendees on how to

best protect highly vulnerable business applications with

interactive panel discussions and roundtables led by subject

matter experts.

The main 'thrust' is to focus on educating attendees on how to

best protect highly vulnerable business applications with

interactive panel.

There are many variations of passages of Lorem Ipsum but the majority have suffered in some form.

Start using PlayThere are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

Up to 1 User

All UI components

Lifetime access

Free updates

Recommended

BasicUp to 1 User

All UI components

Lifetime access

Free updates

Up to 1 User

All UI components

Lifetime access

Free updates

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

401 Broadway, 24th Floor, Orchard Cloud View, London